Spaving: The Sneaky Habit That's Draining Your Wallet – And How to Beat It

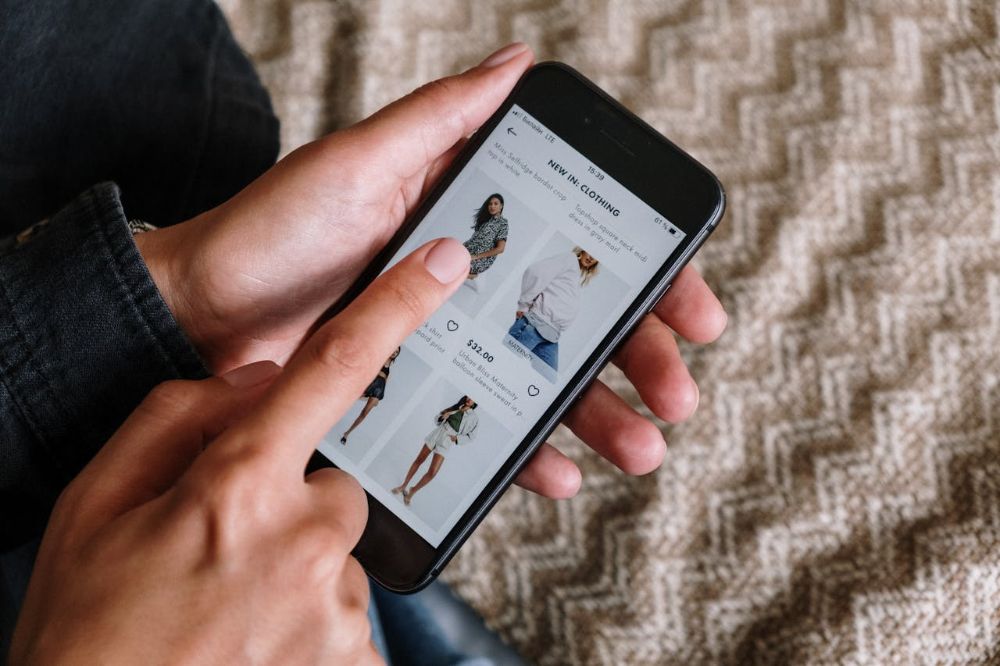

Are you a self-professed lobang queen or king? Do you have that one friend who’s always bragging about the amazing deals they’ve snagged online? You may have a spaver in the group.

Meet Mandy, our resident spaver. Mandy’s practically the queen of Shopee and Lazada, constantly hunting for the biggest discounts and flash sales. Whether it’s a heavy-duty vacuum cleaner, fancy toiletries, or kitchenware, Mandy’s home is filled with bargains she couldn’t resist. But here’s the real question: does she really need all that stuff?

If this sounds too familiar, read on to discover how spaving is really hurting your wallet.

IMAGE: UNSPLASH

IMAGE: UNSPLASH

Meet the spaver

A “spaver” is someone who spends more to save more. Spavers can’t resist a sale and they’re constantly lured by the idea that they’re saving money in the long run. But let’s be real: is a $20 kettle really a steal if you didn’t need it in the first place? That $20 is still money coming out of your bank account or added to a credit card, potentially racking up interest.

Spaving is a sneaky habit. It tricks you into thinking you’re being financially savvy when, in reality, you’re just spending more. The allure of a sale fosters the idea that by spending money now, you’re saving money in the future. Besides, who can resist being told that they’re smart? However, this mindset can sometimes lead to unnecessary purchases, clutter, and even debt.

IMAGE: PEXELS

IMAGE: PEXELS

The spaving trap

One of the most common traps for spavers is the lure of free shipping. “Spend $50 and get free shipping!” Sounds great, right? Except you end up buying stuff you don’t need just to hit that free shipping threshold.

And let’s not forget the temporary high you get from scoring a great deal. It feels fantastic in the moment, but once the excitement fades, you’re left with buyer’s remorse and yet another item collecting dust.

Even when you get a fantastic sale price, you’re still spending money that could go towards more important things, like building your savings, paying off debt, or investing. Those few dollars here and there add up, making a significant dent in your budget over time.

How to avoid the spaving trap

Spaving might seem harmless, but those small, frequent purchases can add up quickly, impacting your financial health. By being mindful of your spending and implementing these simple strategies, you can break free from the spaving trap and make more intentional, budget-friendly choices.

1. Avoid sale alerts

First things first, remove the temptation. Turn off sale alerts and push notifications from your favourite shopping apps. Out of sight, out of mind. Without those constant reminders of sales and discounts, you’re less likely to make impulse purchases.

The same works for email subscriptions. Click “Unsubscribe” and you get to free up not only your inbox space but also the allure of a seemingly irresistible sale that’s living rent-free in your head.

2. Stick to your shopping list

Before you even think about shopping, make a list. Whether it’s groceries or household items, create a list and stick to it. This way, when you come across a sale, you can reference your list and determine if you actually need the item or if it’s just another impulse buy.

Keep a list of things you are planning to buy in the future. When you come across a sale, check your list. If the item isn’t on there, it’s probably not something you need right now. And don’t even try to convince yourself that you’re forecasting your future needs by buying something at a lower price now – been there, done that. I never needed a vegetable shredder in the last six months and probably won’t need it, ever.

IMAGE: PEXELS

IMAGE: PEXELS

3. Institute a waiting period

The 24-hour rule is your best friend. If you’re eyeing something that’s on sale, give yourself a day to think it over. Often, the excitement of the deal will subside, and you can make a more rational decision about whether you really need the item. Sleep on it and see how you feel the next day. If you feel you still can’t control yourself, perhaps you need a 48-hour waiting period instead. More often than not, you’ll find that the urge passes.

4. Do a quick opportunity cost calculation

You know that annoying feeling when you just can’t apply a “Free Shipping” coupon at checkout because you’re a mere $5 away? Hmph. Gotta squeeze every ounce of margin out of this e-commerce platform whose founder lives in a GCB.

But wait, how much are you actually saving? Yes, you may have saved $2 in shipping costs, but they also made you spend an extra $5 on something you didn’t need. That’s a net loss of $3! Stop girl math-ing.

5. Delete stored payment info

Make it a bit harder for yourself to make those quick purchases. Delete your stored payment information from online shopping websites and apps. By the time you fetch your credit card, the urge to buy might pass, helping you avoid unnecessary purchases.

Bonus: By not storing your payment info, you are also less vulnerable to data leaks. Win-win.

6. Do a spending audit

Take a good look at your spending habits. Go through your bank statements and credit card bills. Conduct a spending audit to devise a plan to cut back.

How much are you spending on non-essential items? Are there particular items where you tend to overspend? Reviewing how much you’ve spent on unnecessary purchases over the year can be extremely eye-opening and motivate you to make changes.

For the latest updates on Wonderwall.sg, be sure to follow us on TikTok, Telegram, Instagram, and Facebook. If you have a story idea for us, email us at [email protected].