The Importance Of Lasting Power Of Attorney, Even If You’re Not Elderly

The thing about life is that it’s full of plot twists. It’s an unpredictable ride where nothing is set in stone. The only thing we know for sure is that, in the end, we die. So we make Wills or buy insurance policies. It’s the one thing we can plan for with certainty.

Yet despite the adage that life is short, life is often decidedly long. And in that time, we can and should make plans for when the worst happens. Youth does not exclude us from accidents and illnesses, so it is important to plan for what happens if we lose mental capacity and cannot make decisions for ourselves. That’s where a Lasting Power of Attorney comes in handy, something that is easily available to everyone in Singapore.

What is a Lasting Power of Attorney?

The Lasting Power of Attorney (LPA) is a legal document that enables someone or more than one person you trust to make decisions on your behalf should you become mentally incapacitated. With it, they may make decisions on your personal welfare, property and financial affairs. These tasks can be as quotidian as paying your bills and as important as making decisions about your health.

“This is prudent to get done when you are alive and healthy. Otherwise, if you become incapacitated without an appointed donee, family members will have to apply to the court to be granted authority, which is costly and time-consuming,” says lawyer Peggy Sarah Yee, director of PY Legal and a specialist in estate and matrimonial law.

What happens if you don’t have an LPA?

Without an LPA, close family members can still apply for a Deputyship Order under the Mental Capacity Act (MCA) to care for someone who cannot make decisions for themselves. “But to do that, you need to have a comprehensive and detailed medical report, which is costly. And let’s not talk about the legal costs,” says Yee. “Applying for an order under the MCA is a long process, and while not insurmountable, it is not your run-of-the-mill application.”

Even if your family has your best interests at heart, they do not get the automatic right to manage your affairs. Also, beyond your own personal health and finances, your mental incapacity could affect what happens to the care of your children or elderly parents. An LPA gives you the opportunity to plan for those instances and ensure that your dependents are not unnecessarily locked out of your assets which may be essential to them.

Because granting the Deputyship Order would give the applicant access to someone else’s bank accounts, properties and important life decisions, the application process is rightfully onerous and can take six months at the very least.

“If you can avoid all that with an LPA, then why wouldn’t you?” Yee adds.

How to file an LPA

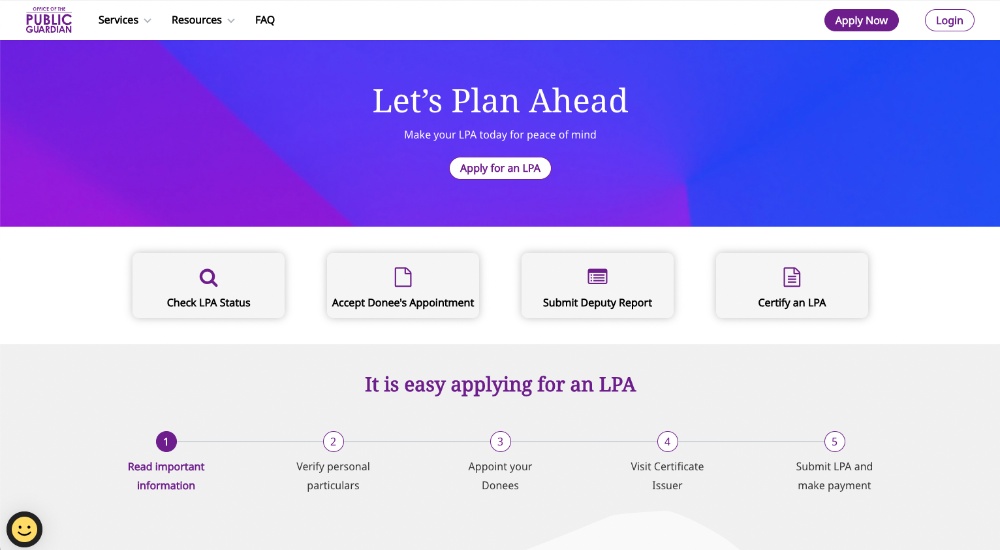

The process begins with identifying and appointing a donee. This could be one or more people and must be individuals you trust will make the best decisions for you. You can choose to give your donees general or specific decision-making powers such as dealing only with your personal affairs or with your financial affairs as well. These choices determine if you should fill in Form 1 or Form 2. Both are available from the Office of the Public Guardian, Singapore (OPA).

The rest of the process is comprehensively laid out on OPA’s website, which you can log into using your Singpass. It includes choosing a Certificate Issuer, a list of which is included on OPA’s website. This is usually a medical practitioner accredited by the OPG, a psychiatrist, or a lawyer qualified to practice Singapore law in a Singapore law practice. Most people use a medical practitioner, who could be your family doctor.

“The most important consideration for the Certificate Issuer is making sure that you are not being lied to or coerced into the decision when you are filing your LPA,” said Yee.

The cost of legal or issuer fees for the LPA typically starts from about $60, depending on the provider. The LPA registration fee is priced at $100 for LPA Form 1 and $250 for LPA Form 2 for Singaporeans. Foreigners pay $250 and $300 respectively.

For the latest updates on Wonderwall.sg, be sure to follow us on TikTok, Telegram, Instagram, and Facebook. If you have a story idea for us, email us at [email protected].