Don't Kena Conned: 5 Ways To Guard Against Scams And Cybercrime

"219 DBS customers lose about S$446,000 to scams in 2 weeks"

"Police warn of new loan scam variant where 9 victims lost $18,000"

"Man loses life savings of $150,000 in job scam on Telegram"

"Woman loses $8,000 after trying to buy $10 king crabs"

Such headlines are becoming scarily common in the daily news, a sign that scams - and the number of people falling for them - are rising at an exponential rate in the Republic.

It’s only the first two weeks of 2024, and it has been reported that 219 DBS customers have been scammed, losing about $446,000 in total. The police and DBS say there has been a rise in SMS phishing scams since last month, where scammers impersonate banks or bank staff.

According to the Singapore Police Force (SPF), scam victims in Singapore lost a total of $660.7 million in 2022, up from $632 million in 2021. This means that scammers managed to steal $1.3 billion from us in the past 2 years 😱

Before you think, "Aiya, confirm is those ah ma and ah gong who are not so tech savvy who kena," think again. In 2022, based on figures released by the SPF, more than 53 per cent of scam victims were aged between 20 and 39. In fact, those aged 60 and above accounted for only 8.8 per cent of scam victims, with most of this group falling for phishing scams.

The reality is, anyone has the potential to be scammed, regardless of age. Here are five ways to reduce your chances of being swindled:

Our ever-vigilant SPF has also come up with an easy to remember acronym, "ACT" (Add, Check, Tell), for you to safeguard against scams.

2. Verify with friends and family

Often, scammers pose as friends and/or family members needing "urgent cash". This number of such scenarios has risen rapidly in the past three years, and was the fifth most common scam in 2022, with victims losing a reported $8.8 million. You should verify requests for financial assistance with friends and family by using other methods (such as calling them).

3. Anti-malware apps are your best friend

Unsure if you just received a scam message? Detect, block, and report scams via the ScamShield App for iPhone or Android). Plus, you can add a ScamShield Bot to check and report scams on Whatsapp.

IMAGE: UNSPLASH/@ED HARDIE

IMAGE: UNSPLASH/@ED HARDIE

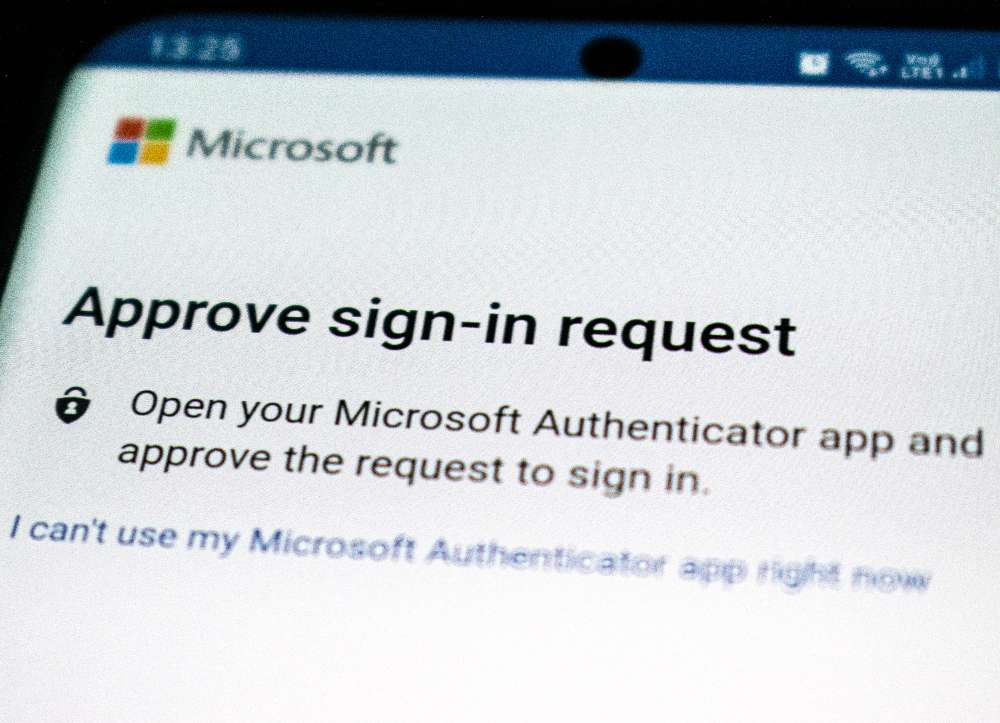

4. 2FA might just save your skin

Multi-factor authentication might be a hassle, but in the event you fall prey to a scam, it could prevent your money from being stolen. Enable two-factor authentication (2FA) or multi-factor authentication for banks, and set transaction limits on Internet banking transactions.

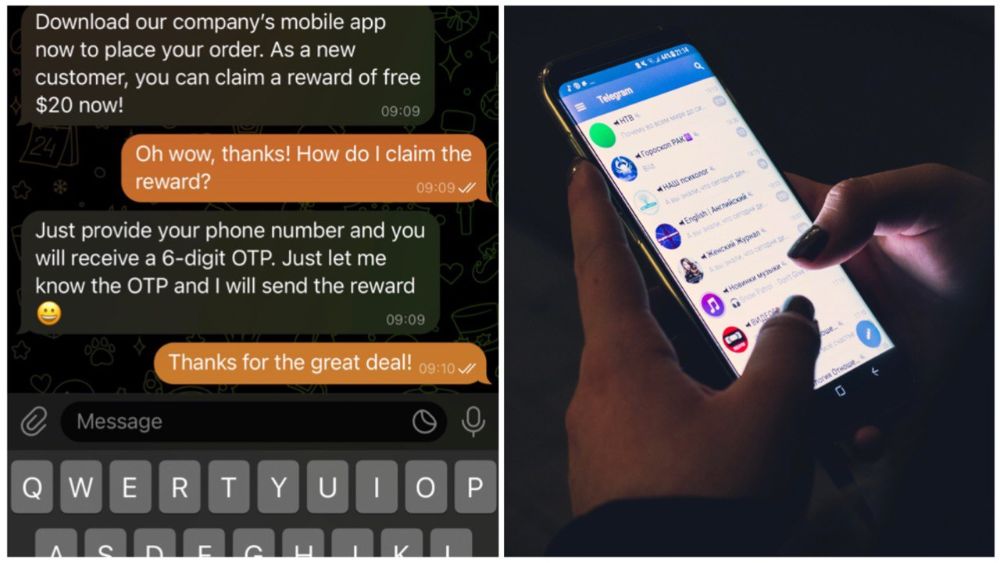

5. Be wary, not greedy

Remember, there’s no such thing as a free lunch. So, if an online advertisement is suspiciously cheap, or the promotion is out-of-this-world-fantastic – run! No amount of crab meat or a shady, lucrative job offer is worth the risk of you losing your hard-earned savings.

For the latest updates on Wonderwall.sg, be sure to follow us on TikTok, Telegram, Instagram, and Facebook. If you have a story idea for us, email us at [email protected].

.jpg?sfvrsn=19bc84b0_1)