Here’s The Lowdown On Buy-Now-Pay-Later Services

Let’s be honest.

Many of us have been taught since young to always pay in full for whatever we buy.

Because 1) not paying may constitute stealing, and 2) no one ever wants to be sent to jail.

For a long time, credit cards were the only solution to legally siam paying up fully when buying something, but now, thanks to some interesting innovations in the fintech space – buying something without paying (at least for that moment) is now much easier, more convenient, and suuuuper legal.

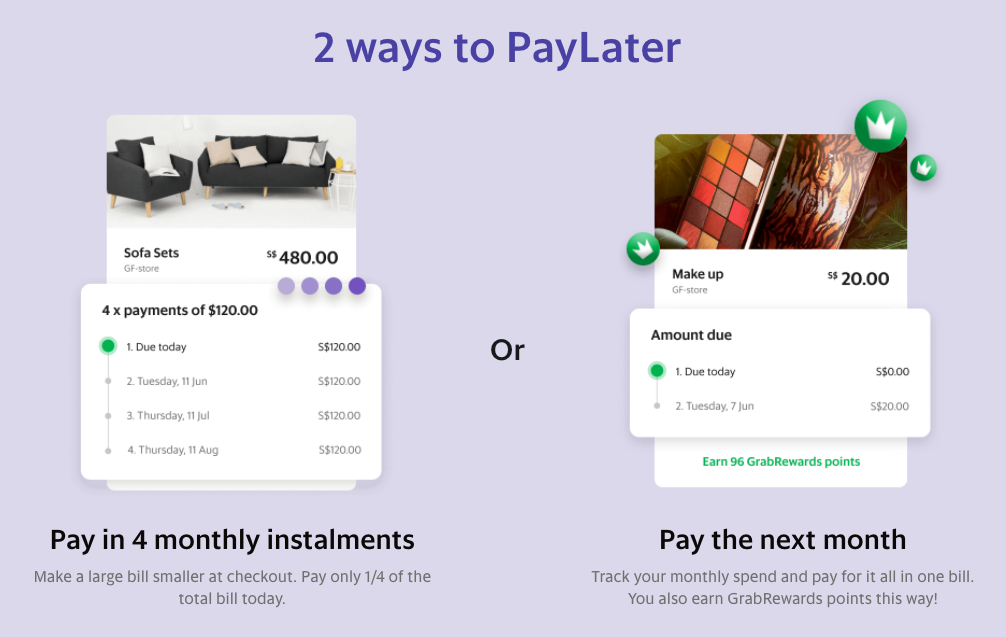

Introducing this new-fangled thing called Buy Now Pay Later (BNPL) services.

Har? What's that? Can eat one?

BNPL services are pretty self-explanatory. These are services that allow users to make purchases and pay for them in instalments over a specified time.

Now, you may be wondering – iPhones can be paid in instalments too, what’s so special?

What gives BNPL services an advantage is that even general, everyday items can now be paid in instalments, with the added perks of no interest fees. The best part? You don’t even need a credit card to register. A debit card is all that’s needed. Shiok.

But I got credit card already leh, what’s the difference?

Turns out, there are differences! Here's a breakdown:

1. 0% instalments

BNPL services tend to offer 0% interest instalments with no processing fees across all items, big-ticket or small-ticket, that are available for purchase using such services. Certain BNPL services also allow you to earn rewards points/cashback/miles for rewards credit cards even with 0% instalment purchases!

Credit cards are restricted to tie-ups with specific major merchants to offer 0% interest instalments over a specific period of time, mainly for big-ticket items. Credit cards are also liable to processing fees for some 0% instalment payment plans and tend to restrict earnings of rewards points/cashback/miles for rewards credit cards on such plans.

2. Ease of use

The barrier for entry is much lower for BNPL services, especially when you don’t need a credit card. Youngins’ can even use these services before they’re eligible to own one! Furthermore, there are no minimum income limits nor employment requirements compared to credit cards – swee lah!

3. Late Payment Fees

Both BNPL services and credit cards charge late payment fees, but they do differ in terms of implementation. Depending on the service, BNPL services can charge late payment fees based on the value of the item or even as a one-time fee.

Credit cards are pretty straightforward when it comes to late payment fees – you’re late, you pay up a hefty sum that usually amounts to 3 figures’ worth. Owe money, pay money.

4. Credit limits

Credit limits are a thing when it comes to both BNPL services and credit cards. BNPL services tend to be more strict, with some putting maximum transaction limits that differ depending on whether a credit/debit card is linked to an account. Compared to BNPL services, credit cards have way larger credit limits, some even up to 4x their monthly income. Chor sia.

Wah, so good, confirm overspend sia.

And you’re probably right! As the saying goes, too much of a good thing is probably bad for you. With all these perks and benefits that come with using BNPL services, it’s much easier to fall into a trap and recklessly spend when it comes to buying items at the tap of a button without any immediate consequences.

A survey conducted by BNPL service Finder discovered that more than 27 per cent of users suffered financially due to a BNPL mistake. It’s important to note that making purchases using BNPL services cause your wallet to get damaged the same as paying in full, it’s just that it suffers a slow bleed instead. Managing and budgeting your finances wisely is key to maximize the value of such services.

Should I use BNPL services?

BNPL services are a great tool for people like you and me to shop with, provided we are responsible enough with our finances. But we find that people on an irregular income would stand to enjoy the benefits of BNPL services the most, such as freelancers. BNPL services help such people make purchases with ease, especially during months when income is on the lower side.

What to choose ah?

The BNPL industry is quickly picking up steam, and many companies are sprouting up to catch a piece of the pie. Atome, FavePay, ShopBack, and even Grab are just some of the BNPL service providers available on the market, and you should always do your revision on service to choose based on the plans they offer and how they meet your financial needs.

Like studying for O levels.

For the latest updates on Wonderwall.sg, be sure to follow us on TikTok, Telegram, Instagram, and Facebook. If you have a story idea for us, email us at [email protected].