How To Start Your Retirement Planning Early Without Stressing

Huh!? Think about retirement now?

You’re not alone in putting off retirement planning – an OCBC survey last year found that 79% of Singaporeans either don’t have a retirement plan or aren’t on track with their retirement plans. Uh-oh.

Whether you’re starting your first job or your CV could already fill a page, retirement planning is something you should be thinking about now, even if it feels like it’s light-years away.

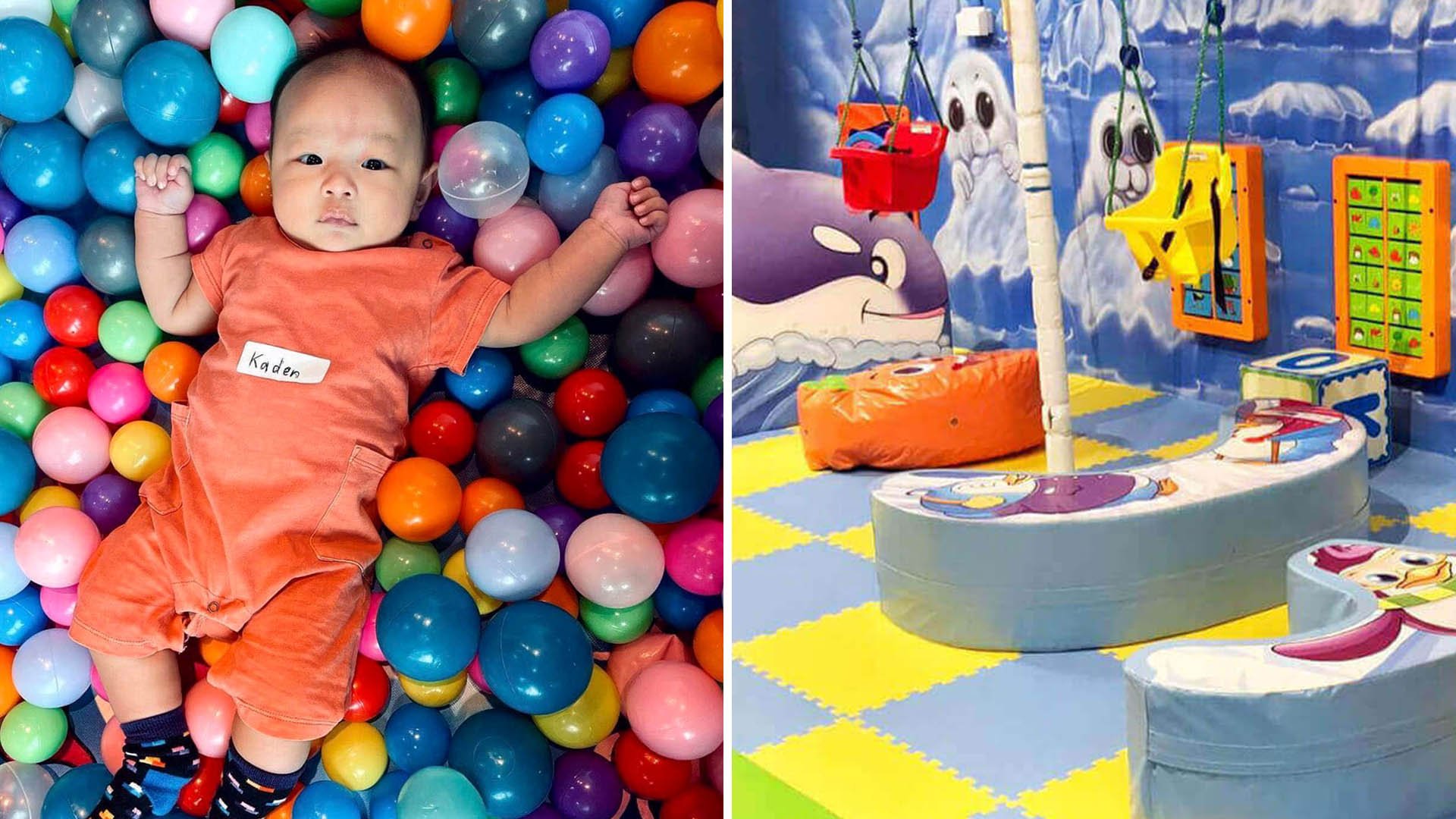

If you’re in your 20s, you’ve got time on your side. Compounding interest can help grow even small amounts into a decent nest egg. If you’re already in your 30s, your income’s climbing, so you can save more, but you’ll also have extra expenses – think: first HDB, kids, and ageing parents to look after.

Retirement planning might seem overwhelming, but starting now is better than starting later. Mai tu liao, here’s how you can start the ball rolling.

IMAGE: UNSPLASH

IMAGE: UNSPLASH

Actually ah… when can I retire?

Singapore's minimum retirement age is 63, and it’ll go up to 65 by 2030. But our gahmen also has a “re-employment age”, so if you love what you do, you can keep working until you’re 68. By 2030, this will bump up to 70.

Wouldn’t my CPF money cover me in my golden years?

Part of your monthly pay goes into your CPF for healthcare and retirement – the Ordinary Account (OA), Special Account (SA), and Medisave Account (MA).

At 55, a Retirement Account (RA) is set up for your monthly payouts, combining your OA and SA.

From 55 onwards, you can withdraw your CPF savings after setting aside the required retirement sum in your RA. Once you turn 65, that sum from your RA is paid to you monthly. If you have $60,000 or more in your RA nearing 65, you will automatically be placed under CPF Life, a national annuity scheme providing monthly payouts for life.

But… CPF Life is likely not enough for a comfy retirement.

The same OCBC bank survey mentioned earlier found that retirement goals for 34% of people in their 20s and 28% of those in their 30s cost around $6,000 a month. Your CPF Life payouts alone probably won’t be enough, especially if you’re only making the minimum CPF contributions.

Then how much do I need?

To estimate how many years it’ll take for the cost of living to double, divide 72 by the inflation rate. This helps you figure out how much to save for retirement.

For example: If inflation is 3%, the cost of living will double in 24 years. If you plan to retire in 24 years and want to cover 20 years of living expenses, here’s the math:

- Minimum annual living cost: $24,000 (assuming $2,000 a month)

- Annual living cost in 24 years: $48,000

- Total needed for retirement: $48,000 x 20 = $960,000

That’s nearly a million dollars! You’re probably panicking a bit now.

IMAGE: SIM DING EN

IMAGE: SIM DING EN

So what should I do?

There are three key components to a solid retirement plan:

1. Accumulate wealth

If you’re just starting out in adulthood, great news! Time is on your side. Your income may not be at its peak yet, but you can start building your wealth by investing and saving consistently.

Since most people in their 20s do not have high financial obligations, it’s the perfect time to save and grow your investment portfolio. Automate a high proportion of your salary into savings, and sign up for a recurring investment plan such as a Regular Savings Plan (RSP), which uses dollar-cost averaging to minimise market risk. Best part? You can start from as little as $100 a month, investing in ETFs, stocks, and unit trusts.

In your 30s, the key to accumulating wealth is maximising your earning power. Find ways to raise your annual salary above the standard inflation rate adjustment. With more cash on hand, fully utilise CPF schemes to boost your nest (think about those monthly payments after 65!).

Top up your SA with up to $8,000 per year and enjoy tax relief. You can deposit up to $15,300 annually into your SRS account and invest in SRS-approved products like ETFs and shares. Outside of CPF, keep investing regularly and diversify your portfolio with growth stocks, ETFs, bonds, and dividend stocks.

When you’re at your peak earning phase from your 40s to 50s, it’s tempting to fall into the lifestyle inflation trap – where the more you earn, the more you spend on non-essentials. Aim to save over 50% of your gross salary, but don’t neglect investing. Start shifting higher-risk investments towards lower-return but less volatile options like bonds and ETFs, and consider adding blue chip dividend stocks to your portfolio.

2. Clear your debt

Nothing eats into your hard-earned wealth more than unnecessary interest payments. Got a bonus at work? Use it to pay off your debt. The more debt you clear, the less you pay in interest, and the sooner you’re free of loans! You don’t want to spend your golden years stressing over mortgage payments.

Automating your loan repayments is great, but it can also lead to complacency. Set reminders to review your loans every two to three years. Consider refinancing your debt to get a lower interest rate. Don’t just stick to the minimum repayments – take the initiative to cut down your obligations as much as you can afford.

3. Generate passive income after your retirement

There’s no reason that your income tap should run dry once you retire. You can still earn through dividend-generating stocks, bonds, fixed deposits, rental income or freelance and consulting work.

Passive income provides an extra safety net on top of your CPF Life payouts and cash savings. In fact, if you can generate enough passive income, you might cover your post-retirement expenses without dipping into your nest egg.

For the latest updates on Wonderwall.sg, be sure to follow us on TikTok, Telegram, Instagram, and Facebook. If you have a story idea for us, email us at [email protected].