Travel Smart And Maximise Savings With Singapore’s Best Multi-Currency Cards

It’s no secret – we Singaporeans love to travel. Don’t believe me? Just think about how many fellow Singaporeans you’ve bumped into overseas, especially in our neighbouring countries! In 2023, we made over 7.87 million outbound departures via air – that’s more than one trip per Singaporean citizen. Given our accessibility to many destinations as a major travel hub, it’s no surprise lah.

But there’s another thing we Singaporeans love – being kiasu. We’re always on the hunt for the cheapest and best deals, so when it comes to spending our money overseas, it’s something we should be kiasu about.

This is where multi-currency cards come in – a die-die must-have for your travels.

IMAGE: UNSPLASH

IMAGE: UNSPLASH

The basics

What are multi-currency cards?

Multi-currency cards are pretty self-explanatory – they’re designed to make it easy to carry and spend foreign currencies. These cards are usually linked to a digital multi-currency account that holds various currencies, making them a great way to optimise your overseas spending compared to just using cash or regular credit/debit cards.

Got so good meh?

It may be hard to believe, but yes – because it’s as easy as topping up your EZ-Link card! For us Singaporeans, all you need to do is deposit SGD into a multi-currency account, where funds are converted in advance or directly at the point of spending, depending on your preference.

These cards also give you bang for your buck by avoiding the high currency conversion and processing fees typically charged by banks or money changers, while still offering close-to-spot-rate currency conversions. Shiok, right?

On top of that, most multi-currency cards support modern payment methods like contactless payment, Apple/Google/Samsung Pay, and ATM withdrawals in case you need some cash in a jiffy.

(*Rates among banks may vary, but for reference – UOB charges a whopping 3.25% administrative fee on the amount converted! Chor sia.)

How do I choose the best multi-currency card?

With so many options out there, it can make anyone pek chek trying to figure out which card is best. Here are some factors to consider:

Exchange rate

This is probably the most important factor – after all, we’re looking to be kiasu with our savings! Always compare the exchange rate of your desired currency with rates from Google or XE.com to ensure you get the best deal.

Fees and limits

Some cards may have extra fees and limits for actions like top-ups, ATM withdrawals, or even monthly fees for added features.

Number of currencies

Keep an eye on the currencies your card supports to ensure it covers those you frequently use for travel or online shopping – some cards may have limits on the number of supported currencies. Don't anyhow choose!

Features and ease of use

Some cards come with a user-friendly mobile app or online platform to manage your funds while you travel. Also, look for features like foreign currency transfers to other accounts. So convenient!

What is the best multi-currency card in Singapore?

Each multi-currency card is tailored to different preferences based on the factors mentioned, so there’s no single best option. Like choosing between JC or Poly, you need to choose what’s right for you. However, to help you decide, we've highlighted three cards for three different types of users!

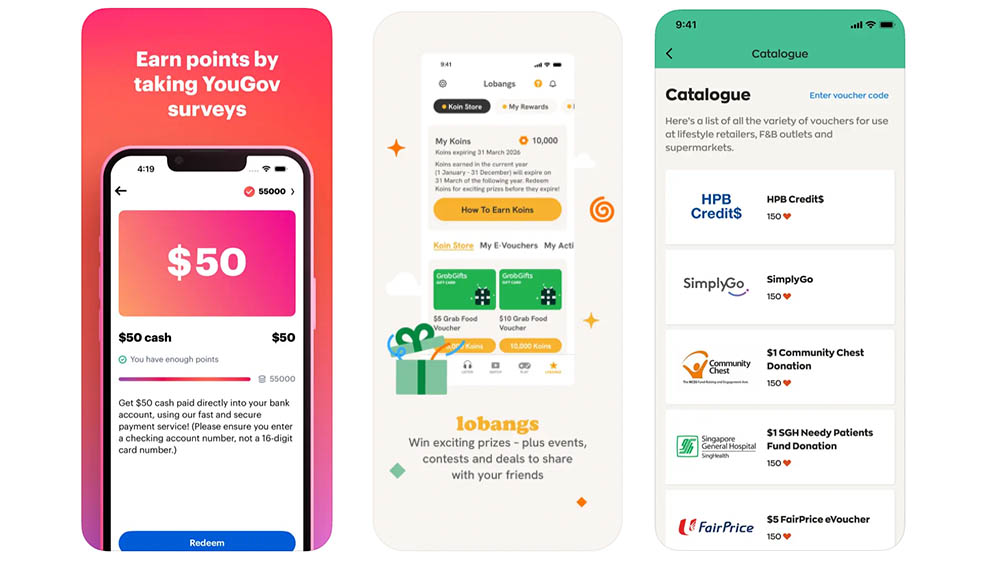

For the Cost-Saver: YouTrip

When it comes to cost savings, YouTrip is hard to beat. I’d recommend most Singaporeans start with this card for their travels, as it supports over 150 currencies with no overseas transaction fees and currency exchange fees. Steady lah!

With a sleek mobile app, all you need to do is:

- Deposit SGD to the app via PayNow, a linked bank account (eGiro), or Visa/Mastercard

- Convert funds to your desired currency (if you prefer)

- Spend on overseas merchants using the YouTrip physical card or your mobile wallets

It’s that simple! YouTrip also supports bank withdrawals in SGD too.

However, there are some cons. Bank withdrawals are limited to 10 a month, YouTrip only supports holding 10 currencies, and you’re limited to free ATM withdrawals of up to $400 total a month – additional withdrawals incur a 2% fee.

For the Globe-Trotter: Wise

Wise may not be the most cost-efficient option, but it supports the most currencies (40+) that can be held – perfect for those who travel frequently. Wise also offers transparent currency conversion rates that are easy to check online. Perfect for the blur folks.

If you’re looking to hoard more cash, Wise also supports two free $350/month ATM withdrawals ($700 total), compared to YouTrip’s $400/month limit.

For the Reward-Seeker: Instarem Amaze

For those looking to maximise rewards, Instarem Amaze is your preferred choice. Instarem allows you to link your credit card to earn InstaPoints rewards on top of your credit card rewards or cashback. You earn 0.5 InstaPoints per SGD $1 equivalent spent in foreign currency.

However, Instarem does not currently support linking Visa cards, and there’s a cap on the number of points you can earn per month (500). For reference, 1000 InstaPoints can be redeemed for $5 cashback. Not bad lah.

So, there you have it – finding the right multi-currency card can be a real game-changer when you travel or shop online. Whether you're the kiasu type hunting for savings, a globe-trotter juggling currencies, or a rewards chaser, there’s a card out there for you. Safe travels, and happy spending!

For the latest updates on Wonderwall.sg, be sure to follow us on TikTok, Telegram, Instagram, and Facebook. If you have a story idea for us, email us at [email protected].