How To Make Your Credit Card Work Harder For You

Credit cards used to get a bad rap because not everyone knew how to handle their finances, leading to unhealthy spending habits and getting into huge debt. Now, thanks to social media, personal finance is gaining traction and more people are learning that credit cards can be a valuable financial management tool when used responsibly.

If you still think that credit cards are the pathway to financial doom, you might just change your mind by the end of this article. We’ll teach you how to put the lit in your financial literacy by making full use of your credit card.

Build your credit score (can’t stress this enough)

One of the most important things you should do when you step into adulthood is to establish a healthy credit history or good credit score with banks so that your chances of securing a loan in the future is boosted (trust me, this will come in handy when you ask bae the golden question of “BTO ai mai?”).

To do so, ensure that you pay your credit card bills on time each month (even if you don’t pay in full) so that you build a track record that proves that you’re a trustworthy borrower who will not default on debt obligations. Do this with multiple banks over a few years and voila, you’ll have a solid credit score in no time!

Tip: Curious about your credit score? Did you know that you’ll get a free credit report each time you apply for a credit card? Don’t just trash it - read it to check if you’re on track or if you can do more to improve your credit score. The aim is to get that Asian parent-approved “AA” credit score!

Accumulate air miles

If your dream is to chug champagne at 30,000 feet above ground while lying on a flat bed, start accumulating air miles right now. Unless you belong to the high SES echelon of society, business class is not something you’ll fork out thousands for, which means the only way to get that sweet business class flight is to redeem one with air miles.

Ngl, it takes time and discipline to amass enough air miles to score a trip for free. As the name suggests, the amount of air miles required to redeem a particular route depends on the actual mileage of the flight – for instance, flying economy on Singapore Airlines one way to Bangkok only requires 13,500 miles but if Paris is your dream city, be prepared to spend 42,000 miles on a one-way ticket. Business class seats usually start upwards of 21,000 miles and go up to 111,500 miles for flights to the US.

From my experience, one would probably take two to three years to collect enough points for a free return flight. Remember to shop around and go for the credit card with the best mile-earning rate.

Earn cashback to offset the effects of inflation

While no one is safe from the effects of inflation, there is a way to make the money you spend work for you. Aside from earning interest on your savings as a form of cushioning against inflation, rack up some savings as well from spending with a cashback credit card.

The key thing is to apply for a cashback card that suits your spending pattern. For example, some credit cards require a minimum monthly spend of $800 before you get to earn cashback at a higher rate. Use a budget-tracking app to monitor your expenses for one or two months to figure out your spending pattern before deciding on which credit card to go for.

Score a free entry to that swanky airport lounge

We all have that one parent (or parents) who are forever kancheong spiders when it comes to flying and demand that everyone goes to the airport a gazillion hours ahead. Instead of wandering aimlessly around Jewel for hours, rest your weary legs at that atas airport lounge you’ve been dying to try. No business class ticket also can!

Most of the credit cards that offer lounge access tend to be either miles-earning cards or geared towards the affluent segment. Fret not, there are several “entry-level” credit cards that offer Priority Pass lounge access worldwide. However, do note that lounge access is not an automatic thing that comes with showing the card – you’d typically have to register via the bank for a membership (but it’s free lah).

Get free travel insurance

This is often overlooked under the list of perks that credit cards offer - you’d be surprised that a good chunk of the market offer this complimentary perk. The caveat is that you’ll have to purchase your flight tickets using the card. The most common coverage offered are personal accident coverage, medical expenses (but these are usually on low limits), travel cancellation and lost baggage. Do keep in mind that these are usually no-frills travel insurance cover, so you might want to purchase a supplementary travel insurance to cover backside if necessary.

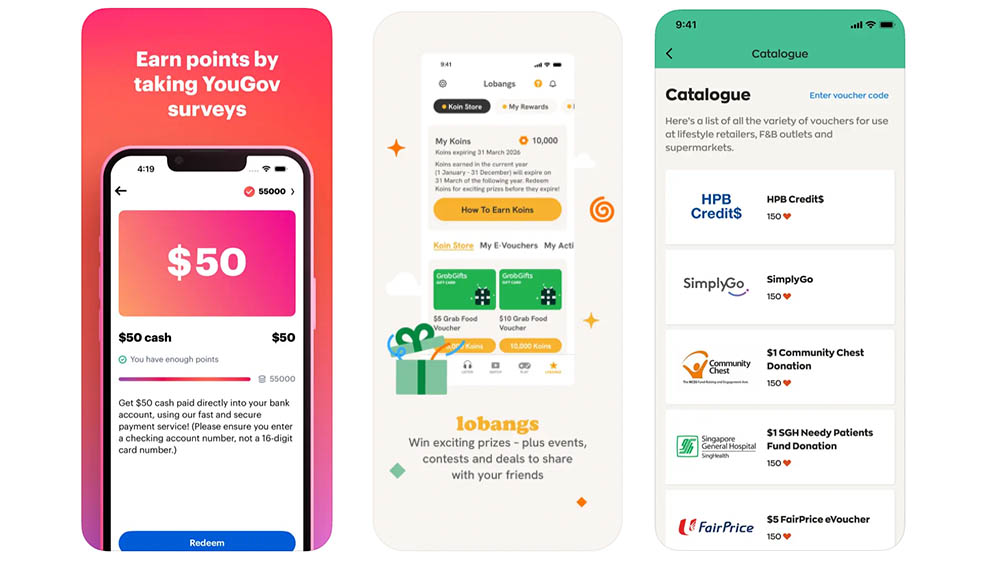

Receive sign-up gifts

Been eyeing that Dyson vacuum or Apple AirPods but don’t want to fork out any money? Here’s a life hack: you could get them for free if you sign up for credit cards as a new-to-bank customer. What’s the catch, you say? Banks usually require you to meet a certain minimum spend within a fixed period of time, but these tend to be achievable amounts considering the average Singaporean monthly expenditure.

For the latest updates on Wonderwall.sg, be sure to follow us on TikTok, Telegram, Instagram, and Facebook. If you have a story idea for us, email us at [email protected].