How To Say 'No' To Impulse Purchases And Stick To Your Budget

Do you ever feel like you’re always broke, and unable to pinpoint where your money’s gone? Maybe it’s that item you bought five months ago, thinking you needed it, but now it’s just taking up space. How now, brown cow?

Impulse buys can be a real wallet-killer, leaving you with regret and an empty bank account. But don’t worry; there are ways to fight the urge to splurge. Here are some tips to help you resist those impulse buys and achieve your financial goals.

Know your budget

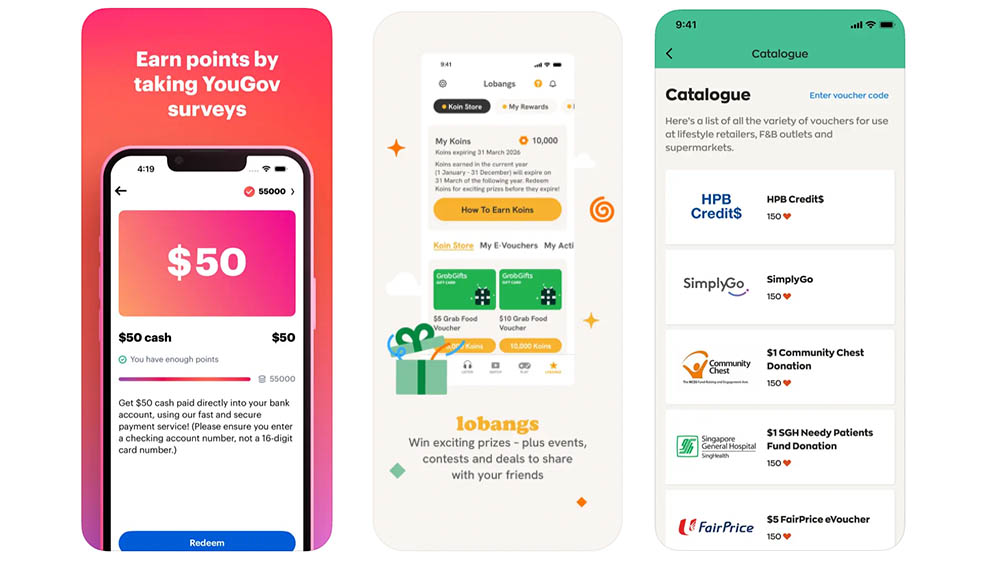

Figure out how much cash you’ve got coming in each month, and then plan your expenditure on essentials such as food, bills, and entertainment. There are loads of budget-tracking apps out there that can help you monitor your spending; some, like Fortune City, even gamify the process.

If recording expenses on an app feels tedious, try “forcing” yourself to do it for just three days, then gradually extend this period to five days, then a week – and before you know it, it’ll become a habit!

Make a shopping list

We all know how dangerous it can be to walk into Daiso “for fun”. Before you know it, you’re leaving with a bunch of stuff that you really don’t need, and will never use again. Without a plan, we’re more likely to succumb to our impulses and spend money on unnecessary things. It doesn’t help that product placement in stores are designed to prey on our impulsiveness.

So before you head to the supermarket or a value chain like Daiso, make a list of to-buy things – either on your phone or using good ol’ pen and paper. If you think you might be tempted, bring along a trusted BFF to keep you in check if you decide to stray into an aisle that’s completely irrelevant to the purpose of your visit.

Avoid shopping when emotional

Studies show that when we’re feeling down or stressed, we’re more likely to visit the mall or hit up online stores for retail therapy. I mean, shopping is cheaper than a visit to the therapist, right?

Instead of mindlessly scrolling through Shopee or Lazada when you’re feeling glum, put your phone away, and shop only when you’re calm and collected. Your wallet will thank you for making thoughtful purchases instead of impulse buys.

Wait before buying

We totally understand the excitement that takes over when something you’ve been waiting for is finally released, and you feel the urge to buy it immediately. But before you hit that “buy” button, ask yourself: do you really, really need it?

Take a deep breath and wait a day or two before making any impulsive purchases. You might realise that you don’t need that fancy new toy in a different colour that looks suspiciously like the one you already have. Give it some time and reassess your desire.

Avoid sales and discounts

That thing you didn’t intend to buy is suddenly 50% off! But hold on, do you really need it (again)? Sure, it’s a great deal, but don’t fall into the trap of buying stuff just because it’s on sale.

Just because something’s discounted doesn’t automatically make it a worthwhile purchase. And let’s be real, buying more stuff you don’t need is just going to clutter up your HDB bomb shelter.

Practice self-control

We get it – saying no to impulse purchases is easier said than done. But as you start to practice self-control and say no more often, you’ll find that it gets easier over time.

Instead of mindlessly scrolling through Shopee when you’re bored or stressed, find alternative ways to cope. Take a walk, call a friend, or meditate – you might be surprised at how much better you feel.

The best part about practicing self-control: you’ll start to yield real benefits for your bank account. You’ll have more money to put towards your goals, whether that’s saving for a vacay or paying off debt. So keep flexing that self-control muscle and say “no” to those tempting impulse buys. Your future self will thank you.

For the latest updates on Wonderwall.sg, be sure to follow us on TikTok, Telegram, Instagram, and Facebook. If you have a story idea for us, email us at [email protected].