What I Learned About Saving Money Without Investing In Stocks And Shares

Just before my 50th birthday, my financial advisor announced that an endowment policy I’d been contributing to for the past 27 years was maturing. “You’ll be receiving,” she paused as she eyed the documents, “$15,000.”

I remember the day I signed up for that policy. I thought it would be a nice gift to myself on a milestone birthday. But $15,000? Bless my young heart, which hadn’t yet learnt about inflation in 1995.

The amount sounded like a windfall then. Today, $15,000 is less than the average three months’ salary for Singaporeans my age (according to the Ministry of Manpower, the gross median income of Singaporeans aged 50 to 54 is $5,850).

“Maybe I’ll spend it on a boob job,” I joked to a friend.

“Please, lah,” she laughed dryly. “If you’re lucky, maybe you can get one of your boobs lifted.” (If you’re wondering, a quick Google search told me that the estimated price of breast augmentation in Singapore is between $11,000 and $16,000 before hospital fees, anaesthesia, medications, and consultation.)

I thought about investing the money. With $15,000, I could buy four lots of DBS shares with about $1,500 to spare. But what fun would that be? Eventually, I decided to use it as my young self had intended: For splurging on something to celebrate that I’d come this far without being incarcerated or mired in debt.

So, I bought myself a trip to Antarctica.

IMAGE: UNSPLASH

IMAGE: UNSPLASH

Savvy investors typically advise against investing in endowment or investment policies because they offer low returns. But 27 years ago, I had neither money nor investment smarts. The internet was in its nascent years; if you wanted to buy shares, you had to enlist the services of a broker, and I was too broke for that. Endowment policies were the safest and easiest way to force me to save and grow what little money I had.

I didn’t start saving until I turned 30 and realised that true independence meant being completely responsible for myself. You can’t do that if you hit a snag and run out of money. So, I started putting aside a small portion of my salary each month – better late than never, I reasoned. And I’m glad I did.

Saving (and some CPF) helped me buy my first home – a two-bedroom private apartment —– at 38. At 41, I had enough savings to move to New York for a year to see if I could make a living there. (I couldn’t, but I was rewarded with priceless life experiences.)

Today, at 51, I have enough tucked away to choose the projects I want to work on (I’m a freelance writer) and take several holidays yearly. I certainly cannot be considered wealthy, but life could be worse.

All this is a long-winded way of saying that I managed to save enough for my future without investing in stocks and shares. If you are already a savvy investor, good for you. I’m sure you’ll be far better off when you turn 50. If not, please start saving. It’s never too late. You can start with these three simple steps:

IMAGE: UNSPLASH

IMAGE: UNSPLASH

1. Save a third of everything you earn

Setting aside a chunk of your salary sounds daunting when you feel like you barely have enough, but I urge you to try this for just six months. By the end of that term, you’ll see that you’ve built a nice little stash for a rainy day, like when you need a new laptop or home repair.

At the end of the year, you might even use some of that money for a holiday. The point is that you'll be encouraged to keep going when you find yourself with a lovely little stockpile after a short time.

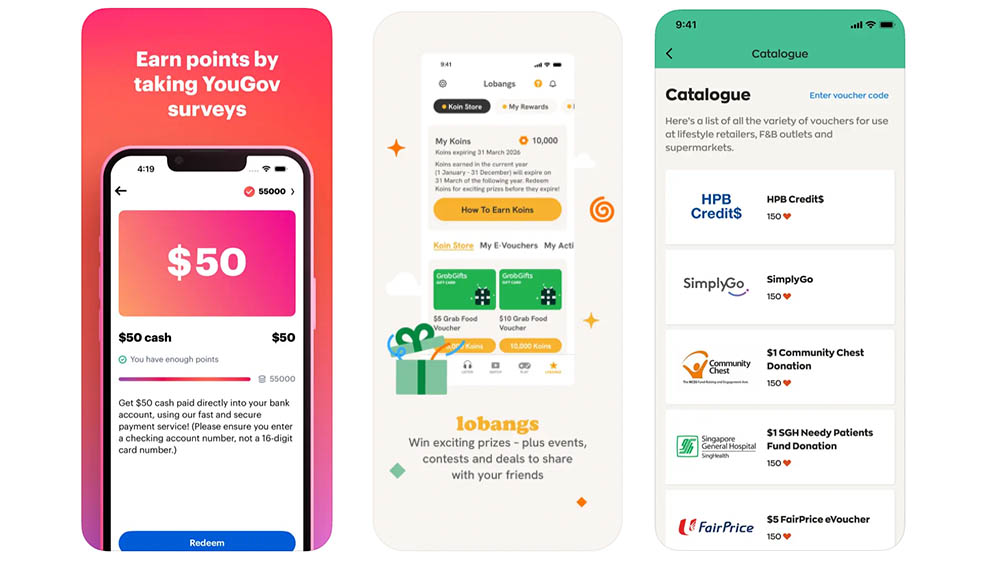

To get started, open a new savings account. You can do this easily online. Ignore the ads for savings accounts that give you higher interest rates if you meet certain monthly criteria. All you need right now is a basic bank account to deposit money you won’t touch for at least six months. Every time you get paid, transfer a third of that amount into this account and forget about it. Once you’ve built a nice stash, you can research higher-interest-rate accounts and transfer your money accordingly. But first, start saving.

IMAGE: UNSPLASH

IMAGE: UNSPLASH

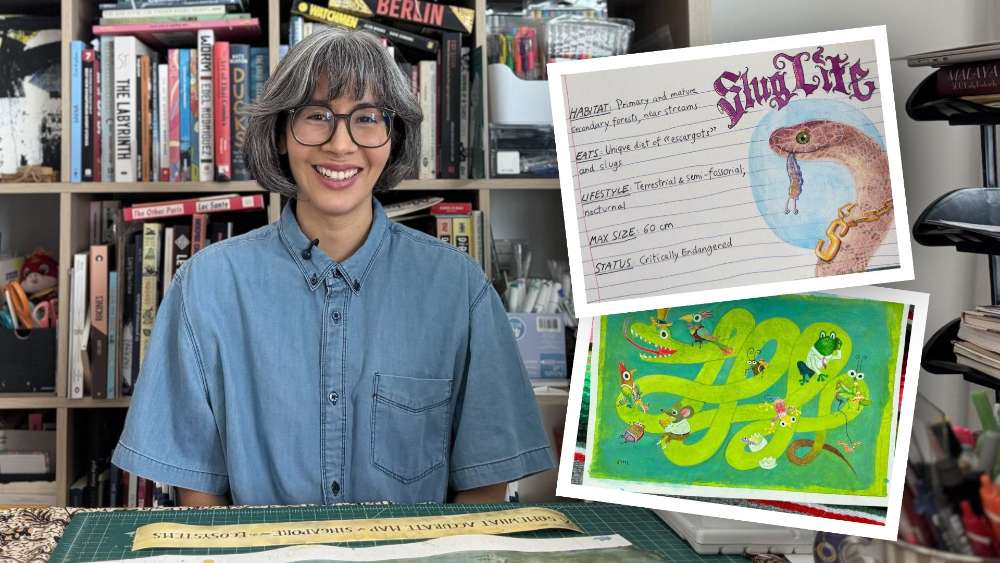

2. Invest in small ways

Cash loses its value because inflation reduces its buying power. Of course, investing is the best way to grow your money, but you shouldn’t enter an investment if you don’t understand it.

Because I didn’t have the smarts, I invested my money the old-school way: In investment and endowment insurance policies. At the time, they were the safest and easiest ways for me to save money.

Today, there are numerous other options, such as low-cost investment portfolios, that you can start with. Research them online and talk to people who know about these investments. Don’t be afraid to ask questions, reject plans you don’t feel comfortable with, and start small.

IMAGE: PEXELS

IMAGE: PEXELS

3. Get medical/health insurance

The young don’t worry about getting old. That’s just a fact of life. But believe the grouchy middle-agers when we tell you that 50 rolls around much quicker than you think. When it arrives, it rocks in with a posse of close friends.

You’ll meet Backache and Weight Gain, who’ll bring with them Chronic Disease, Injury and maybe Critical Illness. These loyal friends are difficult to get rid of, but with good medical insurance, you’ll get along with them comfortably.

For example, depending on the policies you buy, you might be able to receive treatment in a private hospital and/or claim for elective procedures. You won’t have to worry about spending large sums of money out of pocket when you need medical attention.

Of equal importance is when you buy health insurance. Do it while you’re young and healthy. If you wait until you have a pre-existing condition, you’ll pay more. Worse yet, it might even disqualify you from health insurance.

My late father was a classic case in point. He was diagnosed with type 1 diabetes in his early 30s. It was nothing serious. He was told to watch his sugar levels and follow some lifestyle strategies to manage the condition.

In his 60s, he began experiencing diabetic complications, and his heart and kidneys failed. When we began filing his insurance claims, we were told that not only were his claims rejected, but his policies were declared null since the diabetes was a pre-existing condition at the time of purchase (something his insurance advisor should have picked up in the first place).

My parents eventually sold their flat to foot his medical bills.

So do yourself a favour and buy an affordable policy while you’re healthy. A good financial advisor will work with you to upgrade or downgrade your policies as your health and financial needs change with age.

For the latest updates on Wonderwall.sg, be sure to follow us on TikTok, Telegram, Instagram, and Facebook. If you have a story idea for us, email us at [email protected].