Adulting 101: Up Your Credibility By Building Your Credit Score

Swee, you’re now a 20-something-year-old functioning adult. Welcome to the wonderful yet occasionally perilous world of adulting. One of the first things you should check off your list is to build your credit score. If the first thought that comes to mind is “What the heck is a credit score?” or “How to build ah?”, we’ve got you covered.

What’s a Credit Score?

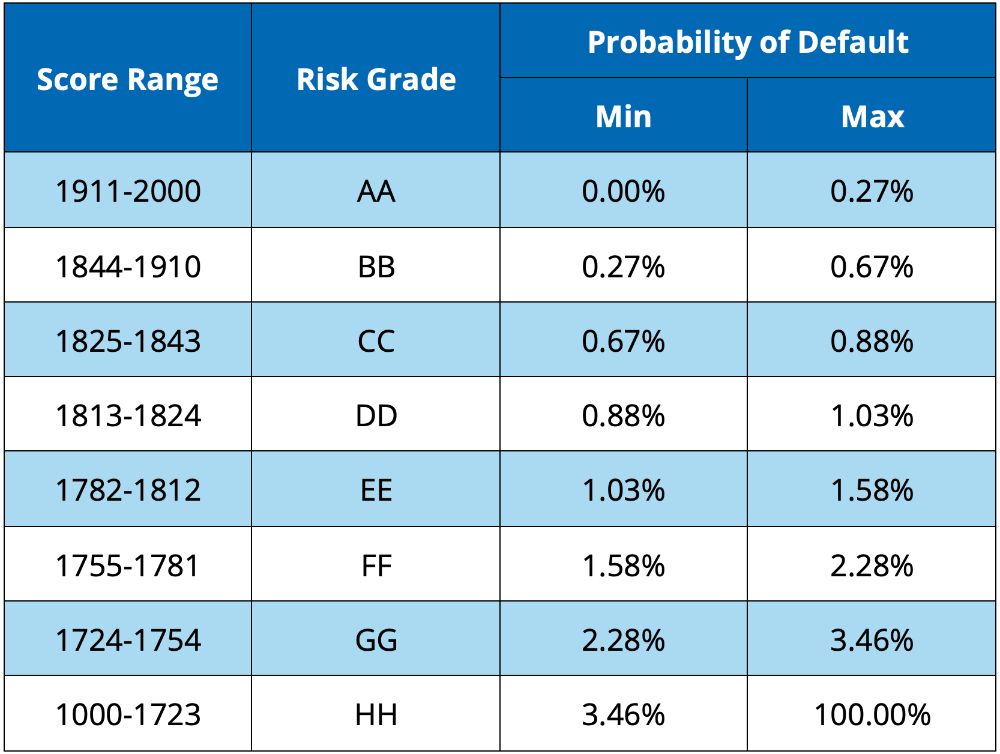

Think of it like your school report card, but instead of being assessed on how well you did in Maths, you’re assessed on your creditworthiness. And yes, they dish out grades too – from “AA” all the way to the undesirable “HH”. The grades correspond to a certain range of probability of default, which is what lenders such as banks are typically interested in when you make an application for a line of credit such as loans or credit cards.

SOURCE: CREDIT BUREAU SINGAPORE

SOURCE: CREDIT BUREAU SINGAPORE

Who grades you?

In Singapore, only two credit bureaus are authorised to obtain credit history and issue credit reports – namely, Credit Bureau Singapore (CBS) and Experian Credit Bureau Singapore. If you’ve applied for credit cards, you would have seen a free credit report offered by CBS after completing your application. Be sure to download a copy as this is complimentary and gives you an idea of how creditworthy you are (so that we can work on fixing that if, say, it will not get your Asian mum’s seal of approval).

Why the fuss?

By now, you should be wondering what the big deal is about credit scores. Tbh, credit scores are used religiously by banks to decide if they will offer you loans or approve your credit card application. A good credit score goes a long way in helping you secure a preferential interest rate on your loans too. Psst! Some employers (especially if they’re in the financial industry) may also do background checks on you prior to offering you a job, which includes scrutinising your credit score.

Having a healthy credit score plays a pivotal role in achieving some of the typical Singaporean life goals such as getting your first home, buying a car, or starting a family. Not to mention that credit cards can be a real ally in fulfilling your #Wanderlust dreams as well.

IMAGE: UNSPLASH

IMAGE: UNSPLASH

So, how do I boost my credit score?

1. Start off with a few credit cards

If you have never owned a credit card or applied for any loans, chances are your credit history is a blank piece of paper. For starters, apply for a few entry-level credit cards (usually those with a low minimum income requirement) as these are usually more accessible and have higher chances of being approved.

Once you get your cards, use them for your daily expenses and be sure to pay them off in full every month. Establish a good track record of at least 12 months of credit history, and you’re on your way to that sweet “AA” in no time.

2. Repay loans on time

Did you know that every time you’re late on your payment (whether deliberately or not), it goes into your credit history? Those black marks will accumulate over time and plunge your credit score into unhealthy territory. We’d recommend making full repayments every month if it’s possible, but if money is really tight that month, be sure to make the minimum payment specified in your statement.

If you’re the forgetful type, set recurring alerts on your phone to remind you to pay your credit card bill or loan instalment and set it to at least two working days before the actual due date. This gives you some leeway in case you’re having a busy day at work and forget to check your phone.

3. Avoid making multiple non-mortgage credit applications at the same time

We know it may be tempting to take advantage of new-to-bank credit card promos, but don’t apply for it all at once! It will give banks the impression that you’re looking to secure a large line of credit or you’re being declined by other lenders.

The same goes for personal loans as it may give the impression that you’re in need of a large sum of money. Instead of making multiple inquiries at different banks, do your homework first and compare interest rates before deciding on your ideal choice.

4. Manage your total credit exposure relative to your income

Having too many credit cards could sound off alarm bells for banks as it may create the impression that you would have a higher chance of becoming indebted. Do some decluttering every six months to cancel credit cards that you no longer use or use very infrequently.

5. Don’t max out your credit cards

High utilisation of your credit cards close to the credit limit is a red flag to most banks as it may imply that you’re spending beyond your means and taking on more debt than you can afford. This reduces your credit score as you’re now deemed more likely to default on your debt repayment.

It’s basic personal finance 101 to spend only within your means even if you have credit cards to tide you over. Use a personal expense tracker, set strict budgets or follow our guide on how to cut down on your spending.

For the latest updates on Wonderwall.sg, be sure to follow us on TikTok, Telegram, Instagram, and Facebook. If you have a story idea for us, email us at [email protected].