Life Hack: How To Save Money On... Everything

A recent YouGov study found that out of the eight key issues mentioned by Prime Minister Lee Hsien Loong in his National Day Rally speech this year, economic challenges due to inflation and rising costs of living was most likely to be ranked as the issue that would affect voters the most – according to 54% of 912 Singapore citizens polled.

I know, we all feel the pain.

Which brings me to a personal finance mantra I stand strongly by – never, ever pay full price for a product or service if possible. Every cent saved goes a long way, and even more so in these current times.

How do you get out of paying full price? Well, here are a couple of tricks up my sleeve that you could use.

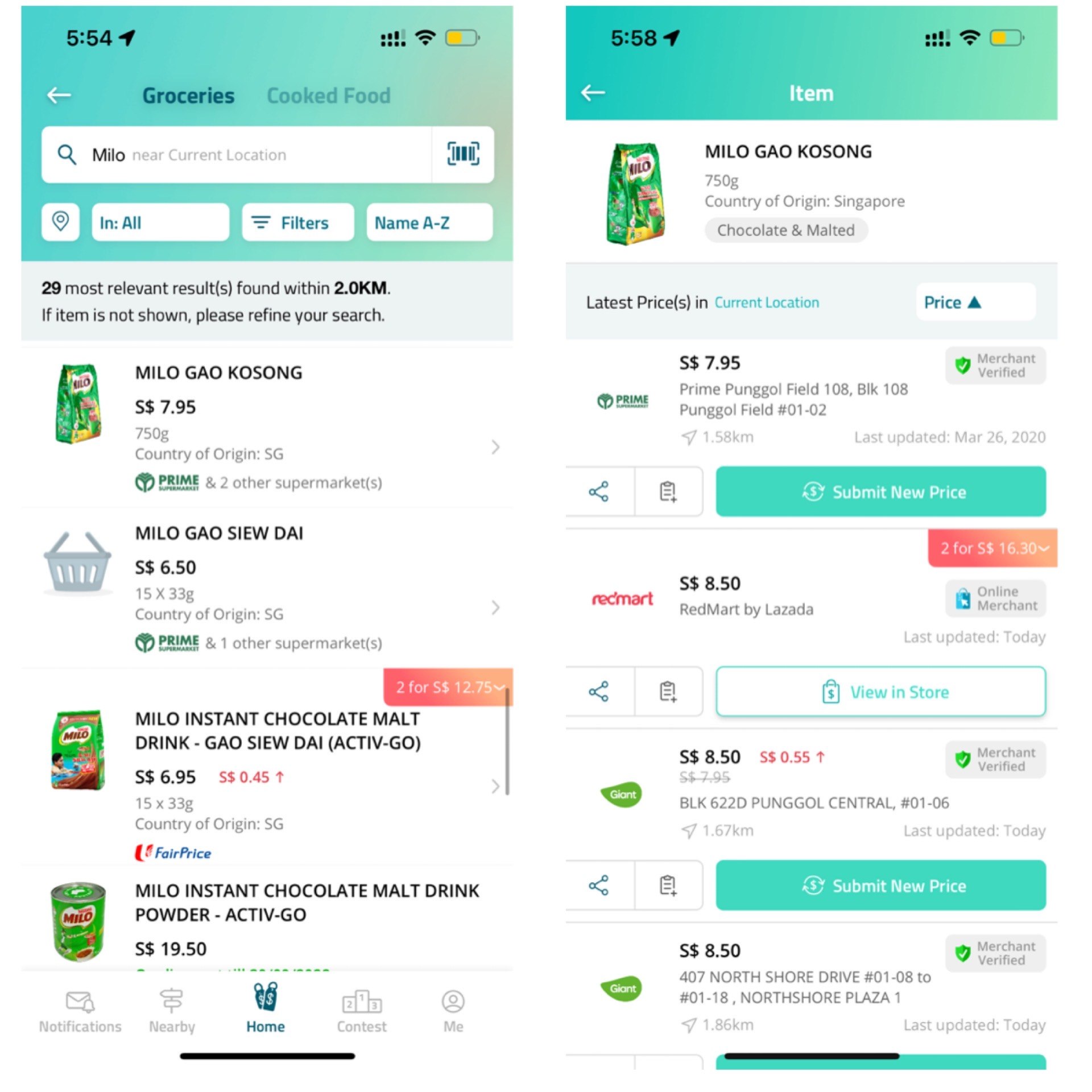

Compare prices online before you make any purchase

My S.O. likes to groan whenever I’m at the supermarket or pharmacy scrolling through the various websites in order to compare prices between the different retailers. Thankfully, I found a less tedious way of doing so with the Price Kaki app. No, it’s not some sketchy app – in fact, it’s launched by our very own CASE (Consumers Association of Singapore) with the aim of helping Singaporeans compare prices of groceries and household items on a single platform.

You can also add items that you regularly buy to “My Shopping List” so that you can receive alerts for any price changes. With the whole process now simplified, there’s really no excuse to settle.

Ace the double-dip game

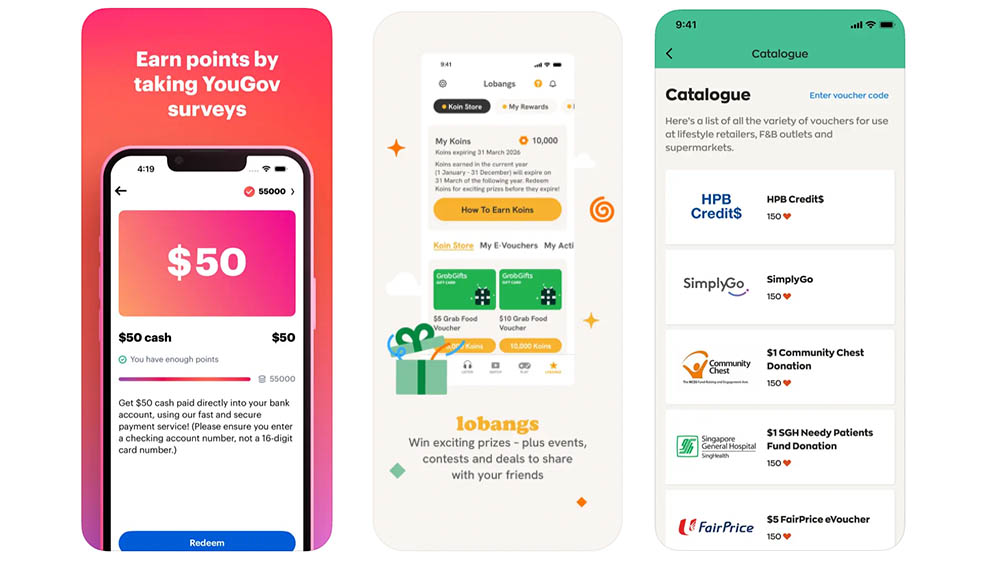

By now, most of us would probably have known that paying by credit card is the better deal compared to cash (just make sure to pay your bill in full every month!). But did you know that it’s possible to double your rewards on a single transaction (hence the term “double-dip”) by paying through an e-wallet or mobile payment app with your credit card?

While most banks have already deemed GrabPay ineligible to earn rewards, you can still pay via apps such as FavePay, Shopback Pay and Kris+ at selected merchants to earn cashback on the platform itself and rewards from your credit card provider. These cashback incentives can then be used to offset your next purchase or withdrawn to your bank account. Swee lah.

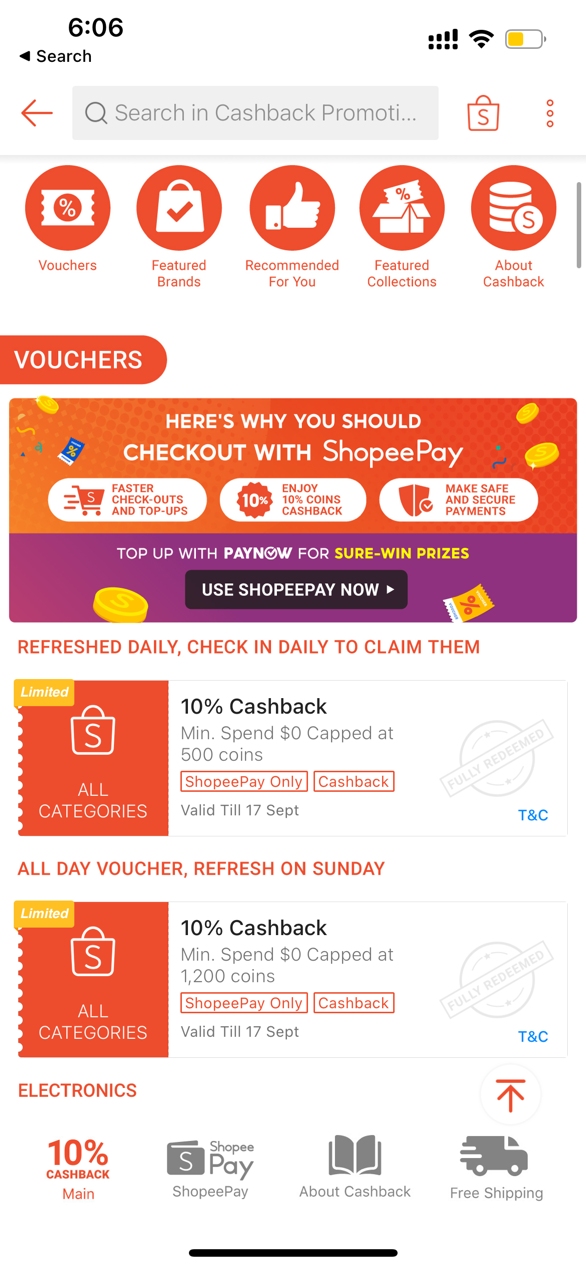

Promo codes are your best friend (online)

If you’re one of those who built up a habit of shopping online during the pandemic, using promo codes should be in your repertoire. The mainstream e-commerce apps release tons of promo codes every day, from free shipping to bank-specific promo codes that can only be used on certain days of the week. As these promo codes tend to be limited in quantity and snapped up quickly, I usually stay up till 12am to snag them.

Food delivery apps also roll out promo codes on a monthly basis, and the key is to use them at the start of the month as some of these codes are only valid for the first few hundred customers.

Dining out doesn’t have to be expensive

Love to dine out but don’t want to break the bank and eat cai png for the rest of the month? Make use of dining discount apps such as Chope, The Entertainer, Burpple or Eatigo so that you never pay full price for a meal. However, these apps do drive behaviour so be careful not to overspend on dining out by going for more expensive meals at a reduced price, which would effectively make this whole exercise pointless.

There are two ways I go about utilising these apps. If I have a restaurant in mind, I will check all the dining discount apps to see if there are any deals for this establishment. And if they don’t, I can always check for promos elsewhere (more on that below).

Facing the common Singaporean dilemma of “where to eat ah”? Decide on a meal budget first, then check the above apps for deals that fall within your budget. From there, it will be easier to narrow down your choices. Voila, now you have a solution to both problems.

Check bank websites for credit card promotions

Most bank websites have a “Promotion” page catered towards their credit card clientele that contains loads of promotions from dining to online shopping to travel. Personally, I have this habit of checking whether my bank offers any discounts, especially when I dine out at more atas restaurants. It’s also very common for banks to tie up with hotels to offer 1-for-1 buffets periodically, so never ever pay full price the next time you want to treat yourself and your BFF to a lavish buffet.

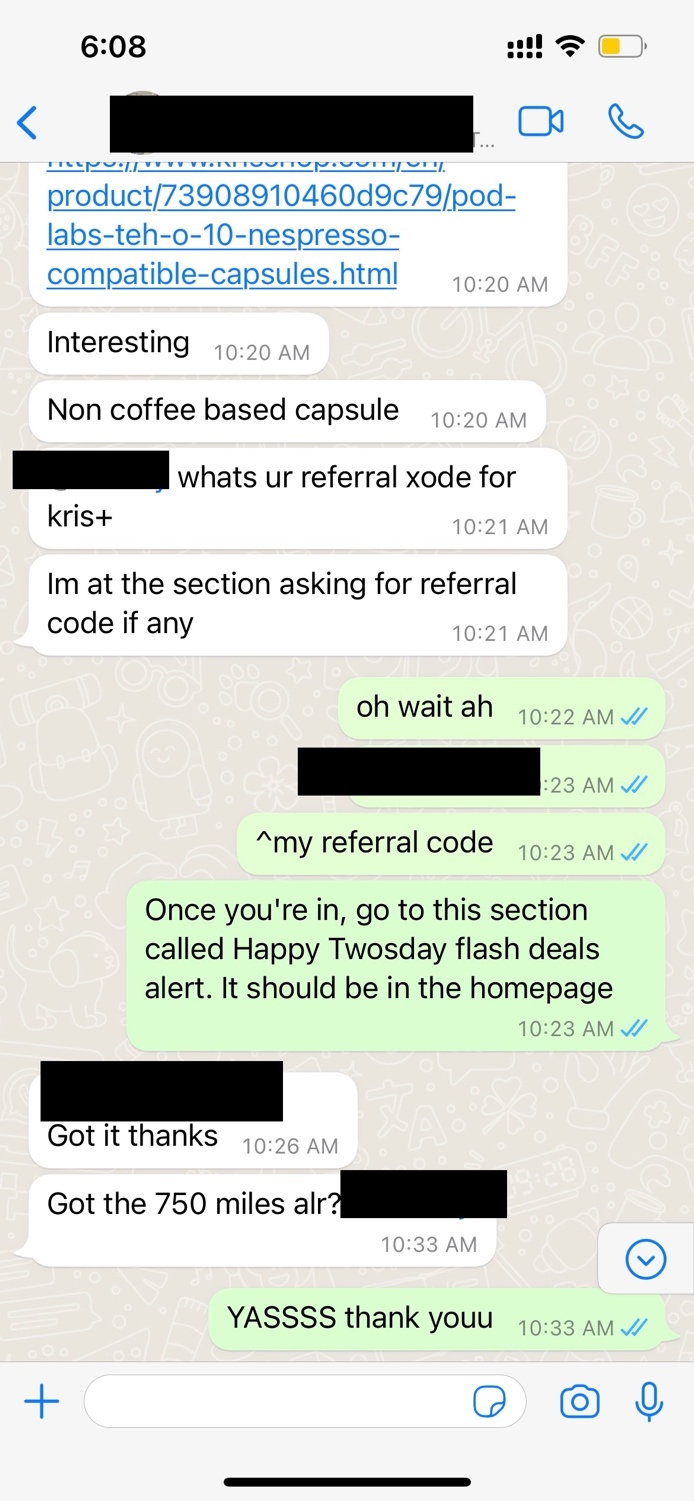

Take advantage of new-user promos or referral programmes

My rule of thumb whenever I download a new app or register for a new service is to reach out to my friends to ask if they have a referral code I can use. It’s usually a win-win situation as both you and your friend will get perks from the company you’re signing up with, typically in the form of cashback or credits that you can use to offset your next purchase. And before you dismiss it as just pocket change, I’ve seen referral bonuses go up to $50!

If there are no referral programmes, check if there are new user promos offered by the company for first-time registration. Examples of this include new-to-bank promos for credit cards (which could be up to a few hundred dollars of cashback) and discount codes that you can use for your first purchase.

Anything to save money, hor?

For the latest updates on Wonderwall.sg, be sure to follow us on Facebook, Instagram and Telegram. If you have a story idea for us, email us at [email protected].