5 Traits Of A Virgin Homebuyer in Singapore

Life in Singapore as a young adult is full of firsts. Your first time going to Jewel, your first time clubbing at Zouk, maybe even your first close shave with a PMD.

But nothing beats buying your first home. Be it an HDB flat, condominium or landed property, it’s everyone’s next big milestone after NS and/or puking in a Grab.

You may not know it yet, but YouGov’s latest survey points out some signs that scream “First-Time Homebuyer”.

Of course, to be eligible you need to be aged between 25 and 34 and not have children. Usually.

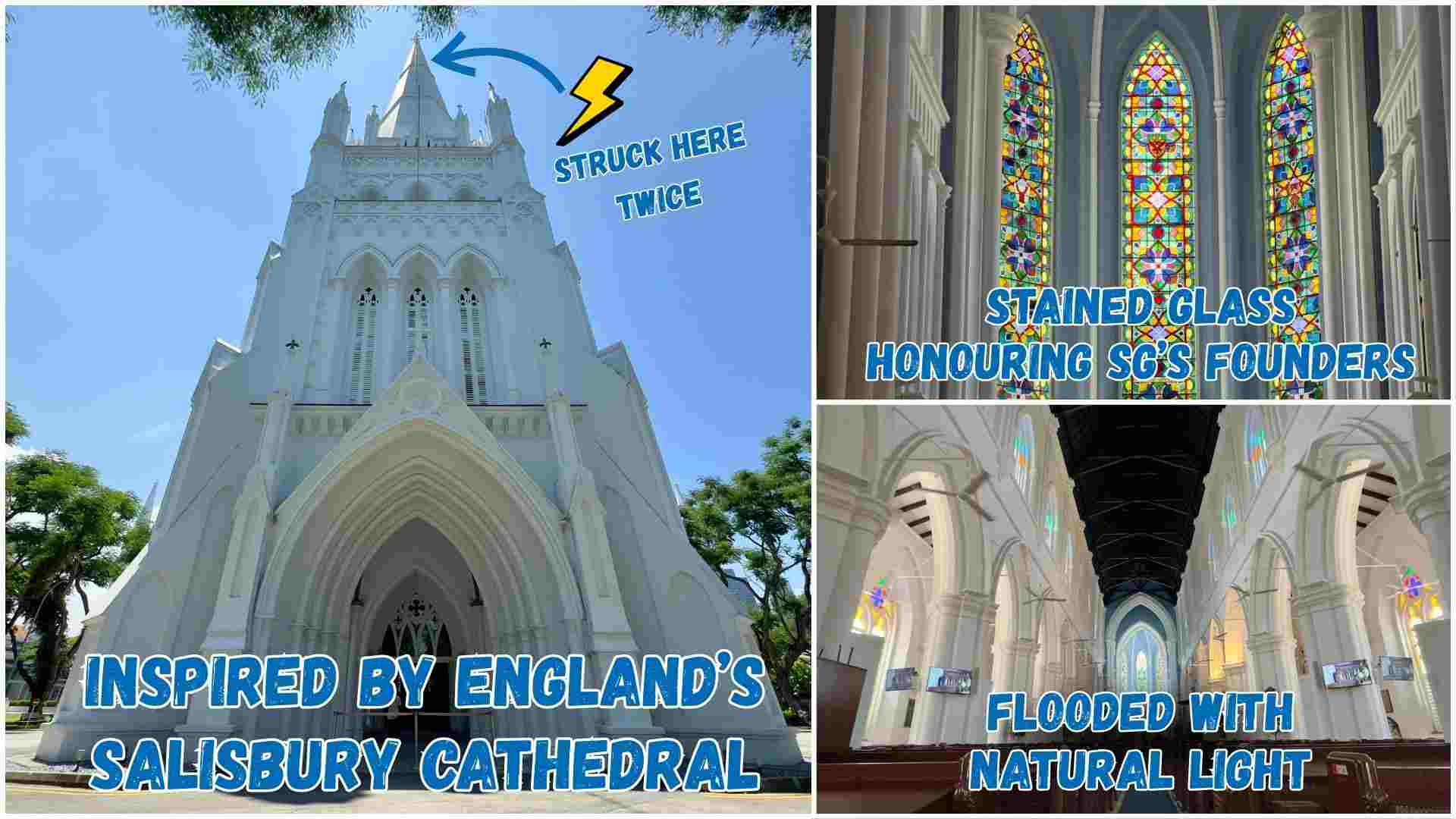

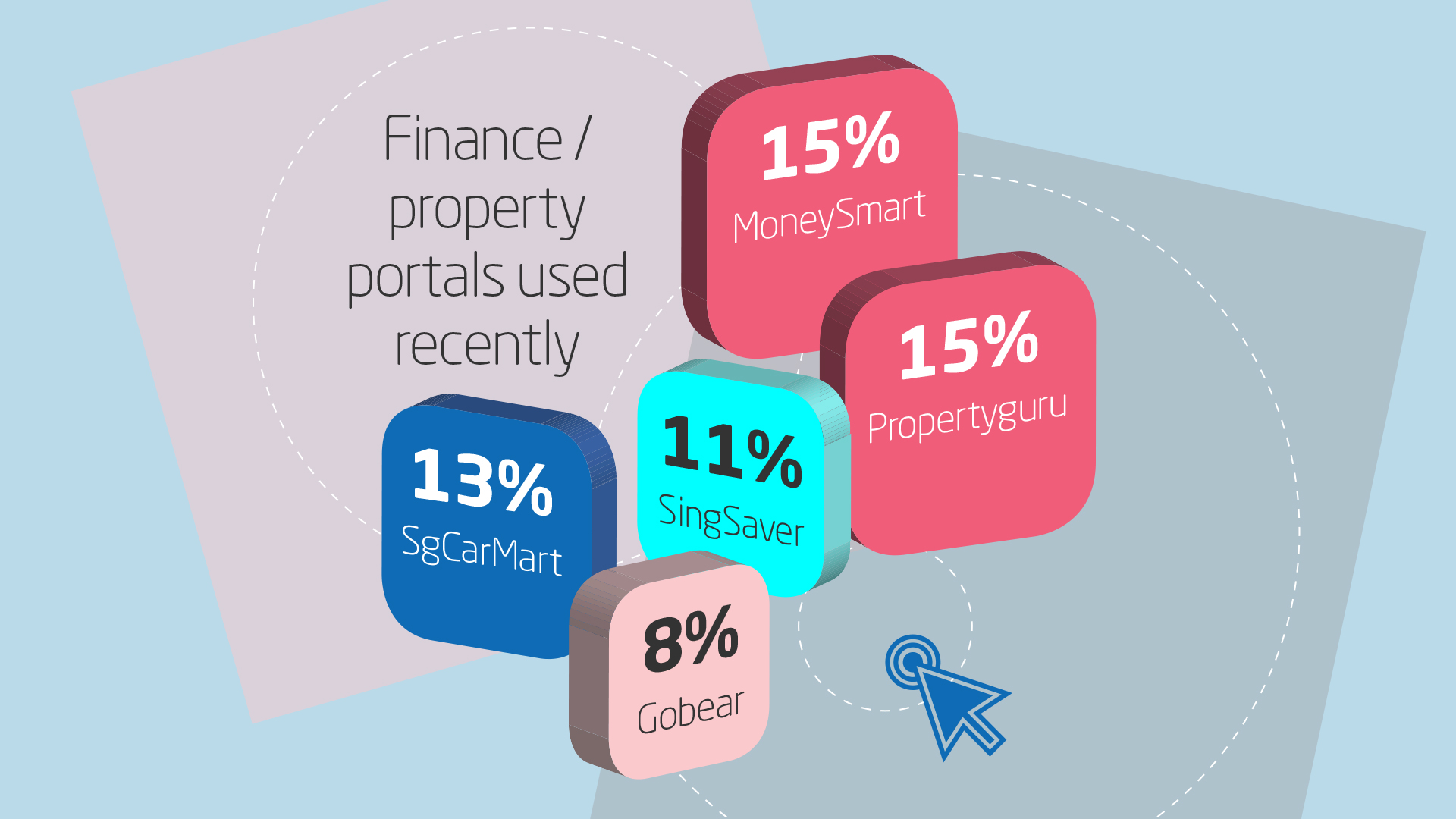

1. Financial / Property Portals

Like Twitter therapy, we always go online for advice. It’s highly likely you would have visited some financial portals.

15% of Singaporeans go to MoneySmart and Propertyguru, while others prefer SgCarMart (13%), SingSaver (11%) and Gobear (8%).

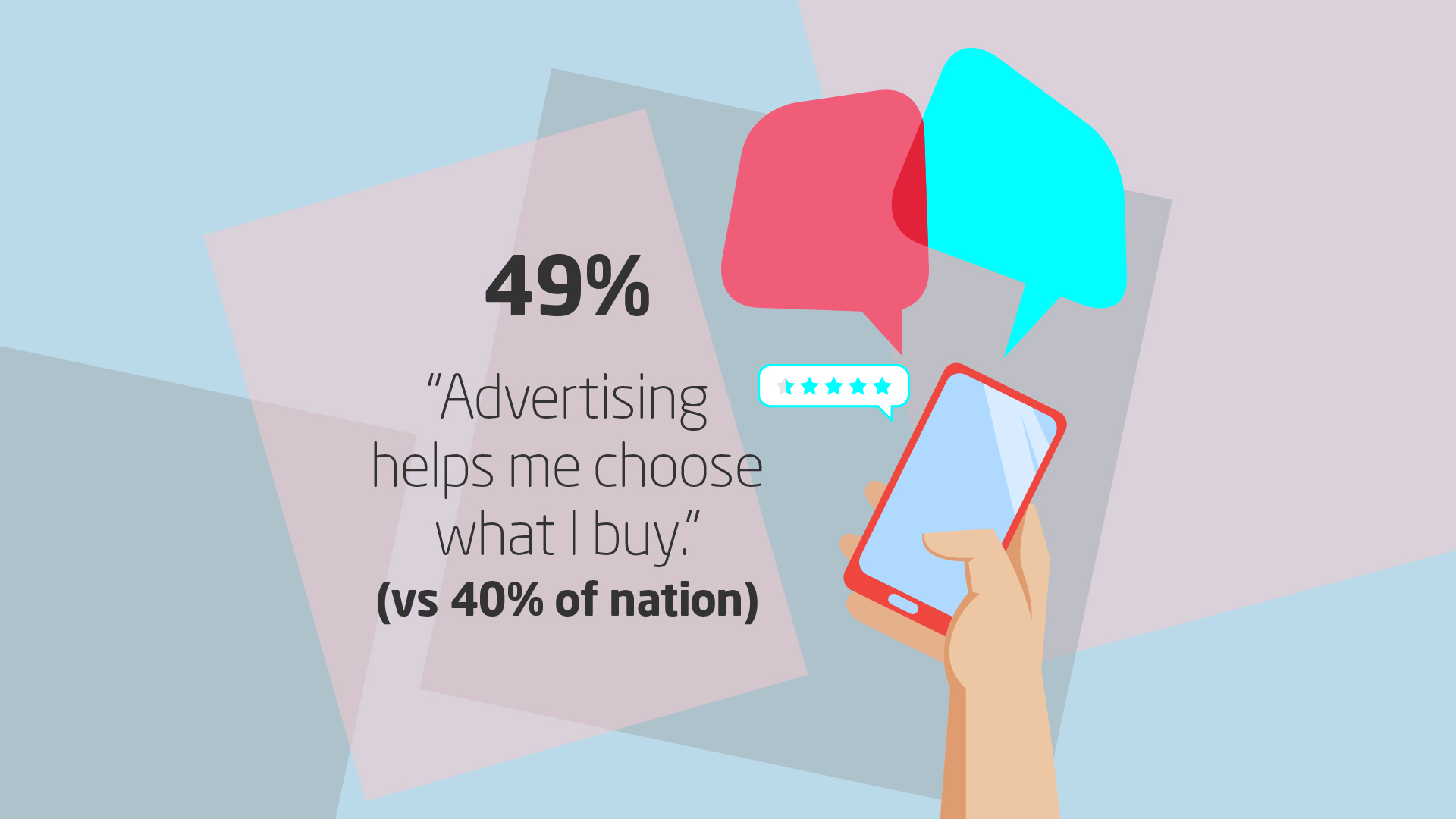

2. “Advertising helps me choose what I buy"

Hypebeast trends and impulse purchases aside, adverts also end up influencing what we buy. If you can relate, you are part of the 49% who are impacted by advertising.

You are also likely to agree with being insured (22%) and getting advice before buying anything new (20%).

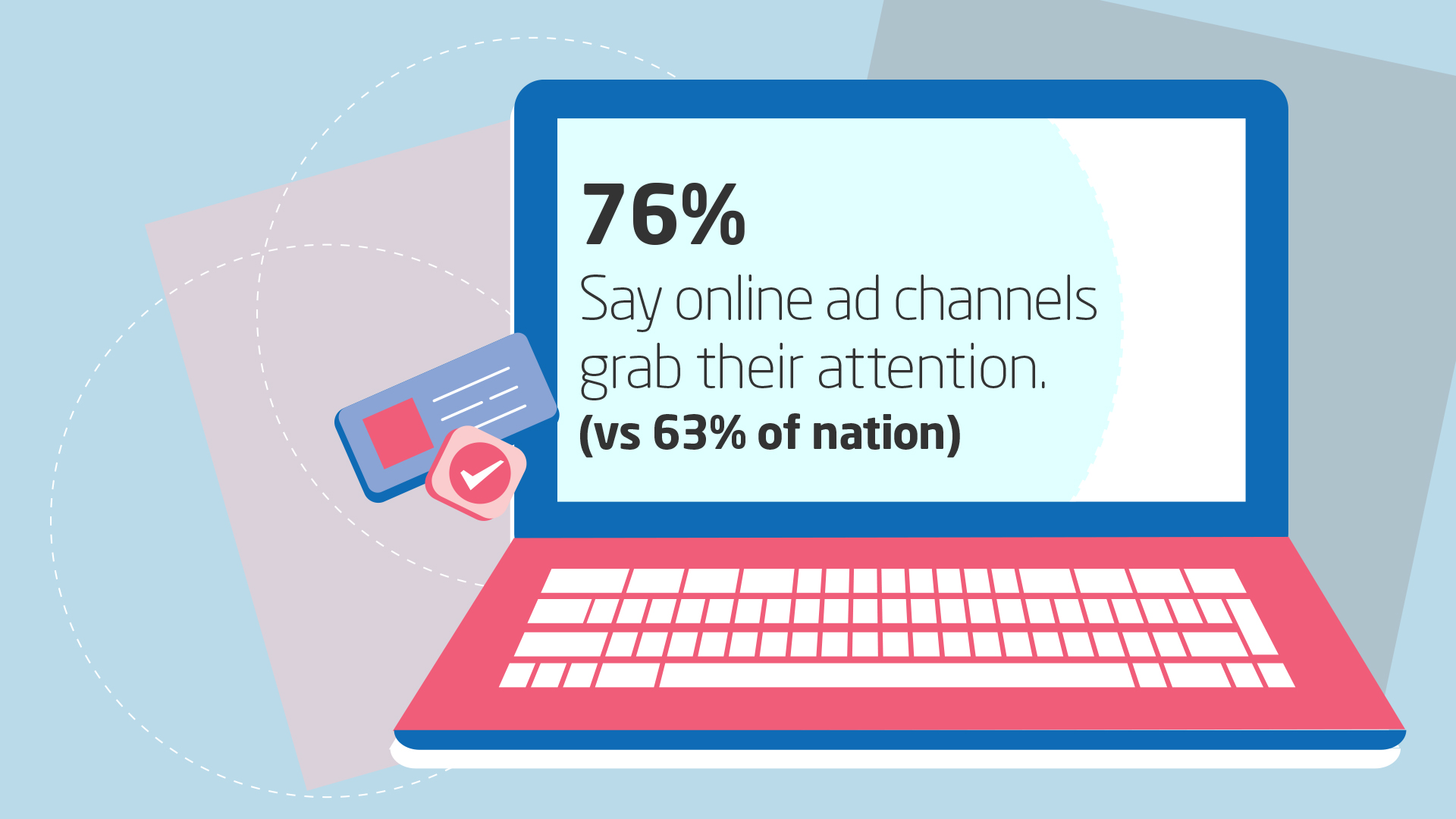

3. Attention Grabbing Ads

While most people would skip an ad, there are a rare few that will catch our attention. 76% of homebuyers are drawn to online ads, while some are swayed by ads shown in the cinema (30%), on billboards (28%) and on TV (25%).

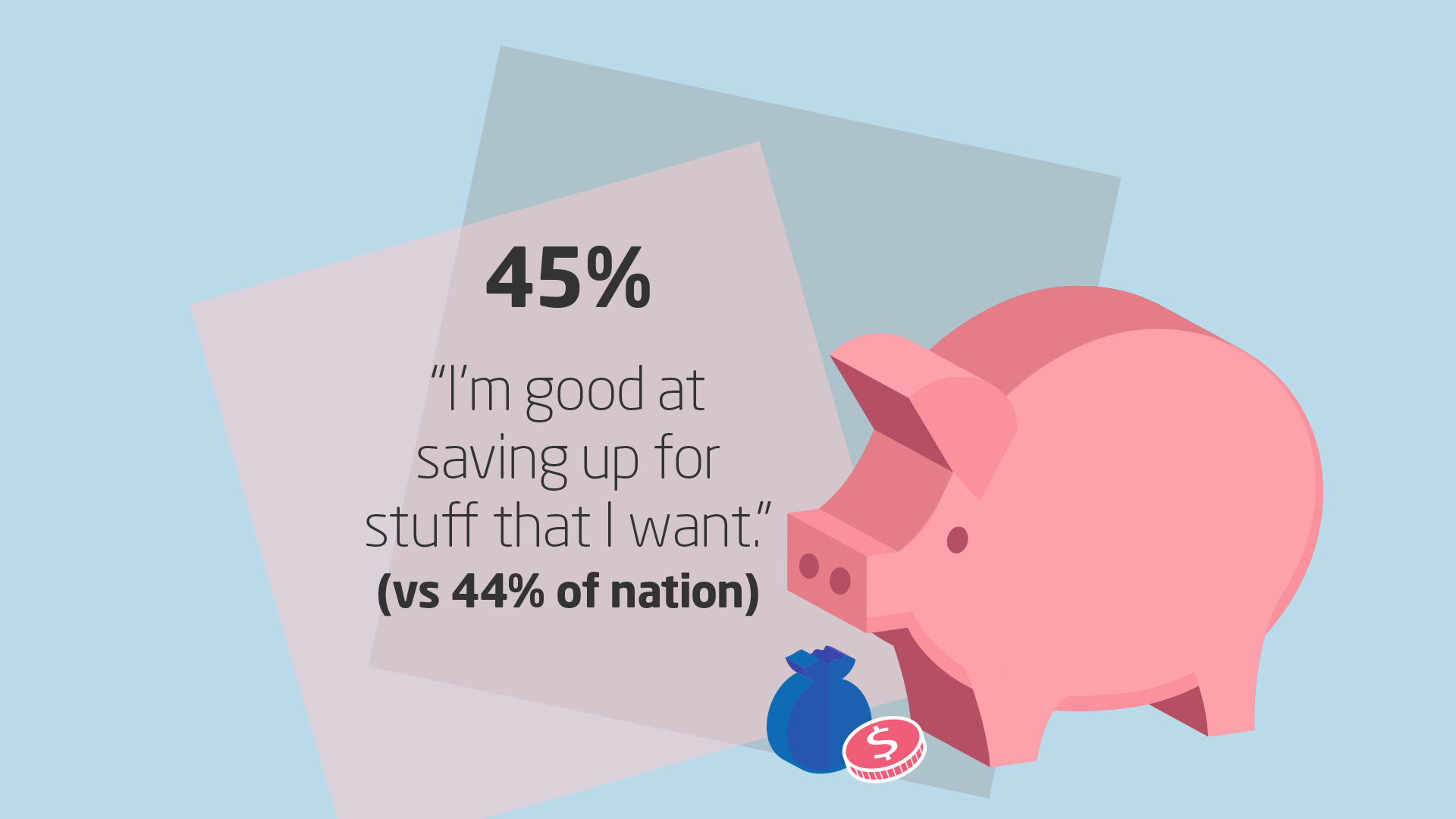

4. “I'm good at saving up for stuff that I want”

As much as some people cannot relate, the numbers don’t lie. If you haven’t blown your money on your daily bubble tea, you belong to this economical 45%.

Although some people say they manage their money well (44%) or will look around for a better insurance deal (20%).

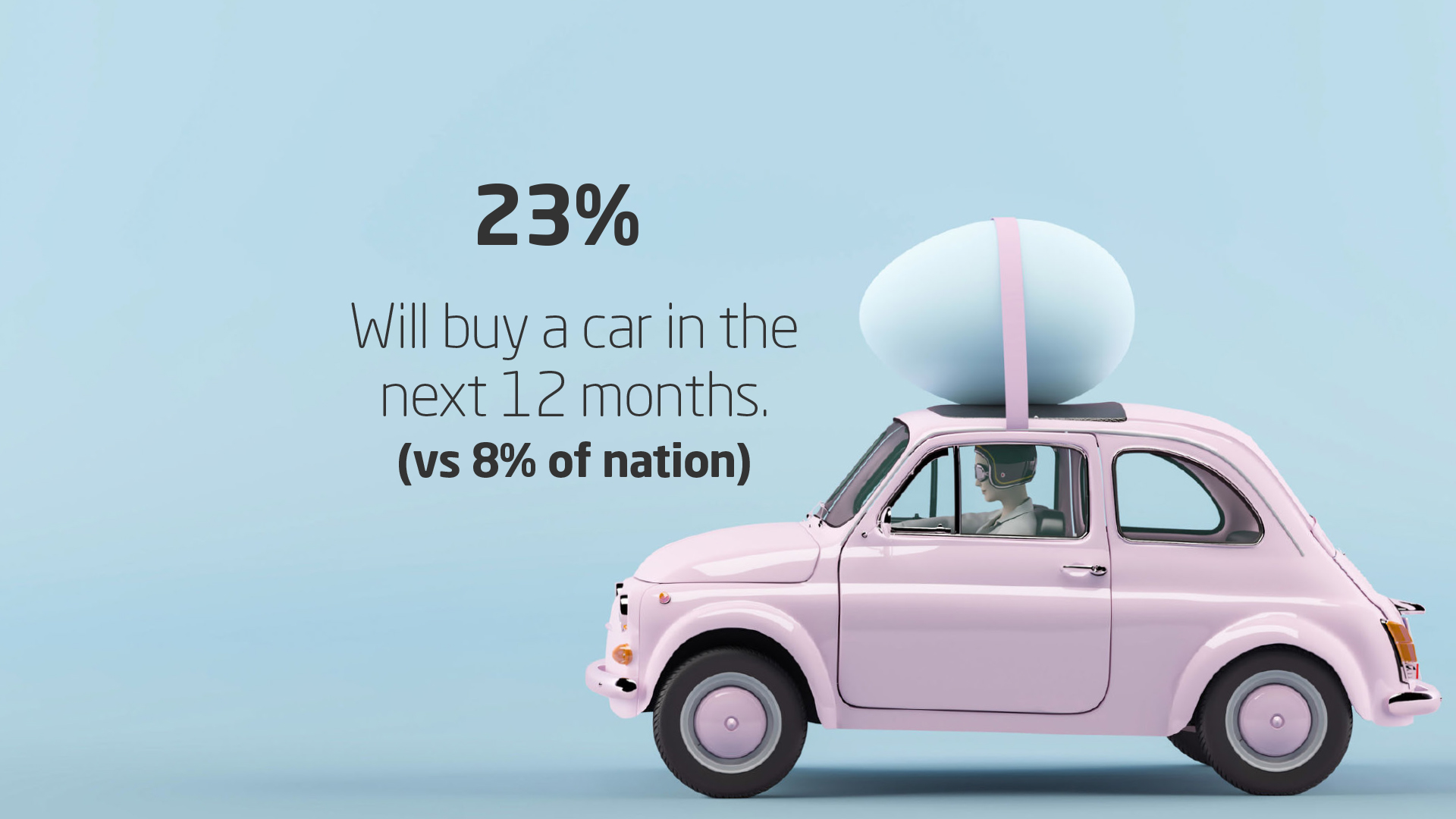

5. Buying A Car

At least, in the next 12 months. The survey showed that 23% of first-time homebuyers are likely to purchase a car within this period.

For the latest updates on Wonderwall.sg, be sure to follow us on Facebook and Instagram. If you have a story idea for us, email us at [email protected]